Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Internet capital markets are happening not just on Wall Street, today all Chinese communities were talking about our new partnership with CMB International. Since our Western community might not be familiar with the Chinese banking system, I wanted to share a bit more on why this partnership matters :

CMB (China Merchants Bank) is one of China’s most influential banks—founded in Shenzhen (China’s Bay Area), and it played a key role in the city’s growth. If you come to Shenzhen, you’ll find CMB everywhere. Fun fact: my home in Shenzhen is actually one of CMB’s properties. 😂

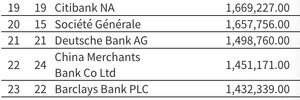

As of April 2025, CMB’s total assets size reached RMB 12.53T (~$1.74T USD). It ranks Top 5 in China, and 22nd globally, just behind Deutsche Bank, slightly higher than Barclays, everyone knows Deutsche Bank and Barclays

This isn’t just any institution—CMB is state-owned. CMB International, headquartered in Hong Kong, serves as a key window into China’s global-facing financial strategy.

TL;DR: A tokenized fund, issued by a major Chinese bank, launching natively on Solana. From Hong Kong to New York—no matter East or West—we’re all building on Solana. That’s the beauty of ICM.

13.8. klo 08.47

CMB International — one of Asia’s leading asset managers — has tokenized CMB’s HK–Singapore Mutual Recognition Fund on Solana as CMBMINT with DigiFT and OnChain 🇭🇰🇸🇬

A few days ago, with the support of DigiFT and OnChain, CMB International, a leading asset management company in Asia, successfully brought their flagship fund onto the Solana blockchain. This is the first public fund on the Solana blockchain globally, which holds significant importance in the financial markets of Asia. The internet capital market is happening on Solana.

11,53K

Johtavat

Rankkaus

Suosikit